The Management Services Organization (MSO) Deferred Compensation Plan™ is a groundbreaking solution designed for privately held businesses.

It addresses critical tax efficiency challenges faced by pass-through entities (PTEs) like S Corporations, while providing powerful tools for retaining key executives.

This plan is exclusively offered through our partnership with Mezrah Consulting, a nationally recognized leader in executive benefit consulting and plan administration.

With over 30 years of experience, Mezrah Consulting has provided tailored solutions to more than 300 companies across the United States. Learn more about their expertise here: http://www.mezrahconsulting.com.

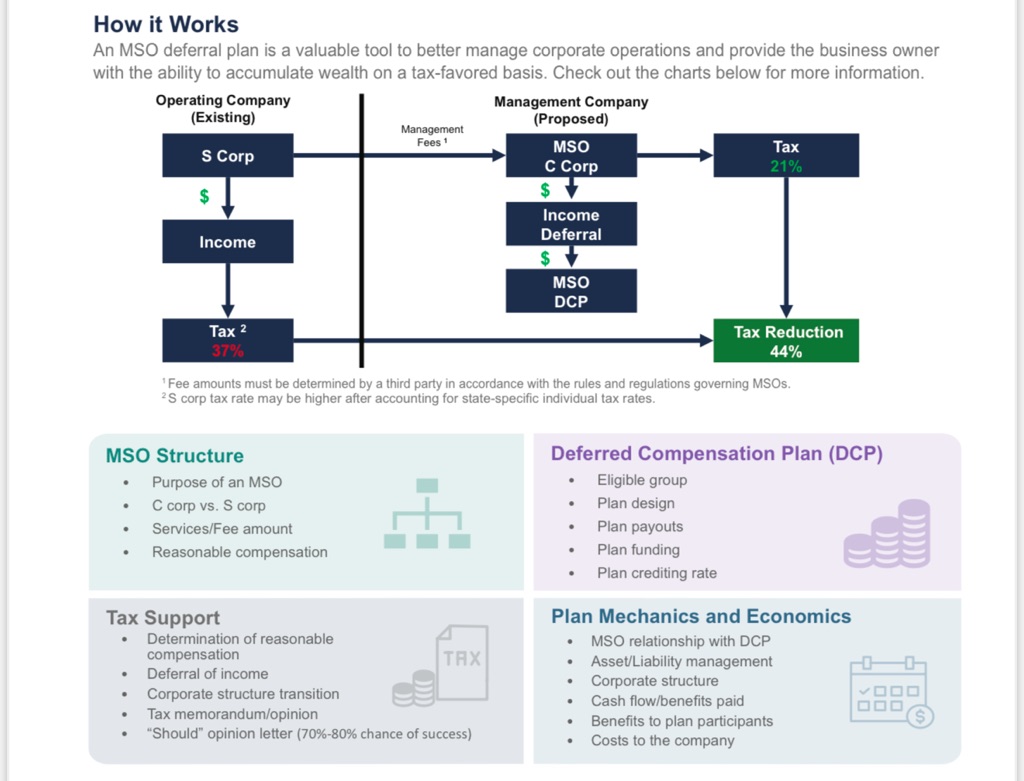

Shift income to an MSO taxed at a lower 21% corporate tax rate, instead of higher individual tax rates of up to 37% (or more with state taxes).

Allow owners and executives to defer income pre-tax, compounding it over time and maximizing long-term wealth creation.

Use funds in the MSO for buy-sell agreements, executive retention strategies, and business growth initiatives.

Strengthen your team by offering competitive, tax-advantaged compensation plans tailored to attract and retain top talent.

Customize the plan to align with your unique business needs and goals, ensuring optimal results.

Guardian Tax Consultants proudly partners with Mezrah Consulting, the exclusive provider of the MSO Deferred Compensation Plan™.

Their expertise in plan design, funding, and administration ensures the highest level of compliance, efficiency, and results for our clients.

Learn more about Mezrah Consulting’s services by visiting their website: http://www.mezrahconsulting.com.

This strategy is ideal for privately held businesses with legitimate business purposes, such as:

– Employee retention and executive benefit programs.

– Non-qualified deferred compensation plans.

– Business continuity and succession planning.

Proper documentation and compliance with governing laws are essential to ensure the success and sustainability of this strategy.

Ready to optimize your tax strategy and retain key talent? Contact Guardian Tax Consultants to learn how the MSO Deferred Compensation Plan™ can work for your business.

Thank you!

Please select the date and time that works best for you. Our expert will contact you shortly by phone.

Schedule a meeting

Fill out the form to schedule a call.