How MSO structuring, deferred comp plans, and corporate transitions pave the way for profitable exits.

As a business owner, you’ve worked tirelessly to build something of value. But what happens when it’s time to step away? Whether you’re preparing for retirement, succession within the family, or selling to a third party, your exit strategy matters as much as your growth strategy—maybe more.

That’s where a well-structured Management Services Organization (MSO) can do more than streamline operations. It can create an exit-friendly framework that preserves enterprise value, lowers tax liability, and gives you tools to strategically manage compensation, distributions, and timing.

At Guardian Tax Consultants, we’ve helped business owners prepare for these moments by integrating MSO strategies, deferred comp plans, and entity transitions that make exits smoother and smarter.

Let’s explore how.

Why Traditional Exits Fall Short

Many business exits are rushed or reactive—triggered by burnout, health events, or unsolicited offers. The result is often:

- A lower valuation than expected

- Exposure to unnecessary taxes

- Confusion around intellectual property or liabilities

- Limited options for how to structure the sale

Often, the business lacks clarity around which assets belong where. Intellectual property, real estate, executive teams, and financial systems may be blended together under one entity—making it difficult to sell, transfer, or finance in a way that preserves long-term value. Without a proactive structure like an MSO in place, you may lose control over how and when you’re paid—and pay significantly more in taxes.

MSO-Based Planning: Tools for Every Exit Path

A Management Services Organization (MSO) allows you to separate your core business functions—like HR, finance, and IT—from your revenue-generating operations. This separation is not only administratively clean—it’s strategically powerful. When done properly, it makes the business more attractive to buyers, easier to transfer to heirs, and more efficient in the way it delivers post-sale income to the founder.

Here are four examples where the MSO unlocks smarter exit pathways:

🔹 Partner or Employee Buyout

When a founder is ready to step back but wants to retain involvement or phased income, the MSO allows for gradual ownership transitions. Equity in the MSO can remain with the founder while younger partners take control of operations. This avoids a cliff-drop transition and creates options to fund the buyout through structured MSO distributions.

🔹 M&A or Strategic Sale

Buyers value clarity. When a company’s overhead, executive functions, and systems are clearly separated from the core operations, it gives acquirers a cleaner picture of what they’re buying. This directly translates into higher valuation multiples and reduced deal friction.

An MSO that owns the real estate, back-office IP, or even key personnel contracts can remain in place after the sale, reducing the buyer’s administrative lift. Sellers benefit from a more tax-efficient structure, and the business gains the flexibility to complete either a stock or asset sale depending on what’s most advantageous.

🔹 Generational Transfer

Family transitions are rarely just about equity—they’re about control, timing, and long-term preservation. The MSO can act as a steadying foundation, providing continued income, administrative support, and professional oversight as younger family members grow into leadership roles.

🔹 Seller Financing via MSO Notes

In cases where the buyer cannot fund a full purchase upfront, the MSO can issue a seller-financed promissory note and create a scheduled repayment plan. Because the MSO pays tax at 21%, the note can be serviced with 44% less pre-tax cash flow than a pass-through entity.

This enables more favorable terms for both parties, improves cash flow coverage on the note, and allows the seller to retain structured income without the same tax drag. When paired with a deferred comp plan, this model provides control and long-term flexibility.

MSOs and Private Equity

MSOs aren’t a new idea—they’ve been a cornerstone in private equity (PE) M&A strategies for decades, especially in healthcare, professional services, and roll-up consolidations. PE firms use MSOs to centralize shared services and drive scale. Structuring your company like this ahead of time makes it more attractive and “plug-and-play” for strategic or institutional buyers.

Use the MSO for Earn-Outs and Consulting

Even after the business is sold, the MSO can stay in place. It can hold earn-out provisions, manage executive compensation agreements, or serve as a platform for consulting services post-sale. This allows the seller to stay active in a tax-efficient way through 1099 consulting or structured payouts—without disrupting the buyer’s ownership path.

Tax Savings = Enterprise Growth

The MSO isn’t just a tax vehicle—it’s a growth engine. When profits are taxed at 21% instead of 40.8%, owners retain significantly more to reinvest in growth, hiring, and strategic expansion. That retained capital can raise EBITDA, improve your multiple, and drive meaningful increases in business valuation at the point of sale.

Flexible Tools for Payouts and Income After Exit

The MSO structure also gives owners advanced tools to manage income after exit—and protect that income from double taxation.

➤ Nonqualified Deferred Comp Plans (DCPs)

One of the most powerful applications of the MSO structure is the ability to implement a nonqualified deferred compensation (DCP) plan. These plans allow the business owner or executives to defer income from high-tax years into future years, while accumulating those deferred dollars inside the MSO.

When paired with Corporate-Owned Life Insurance (COLI) and smart investment strategies, the deferred funds compound tax-efficiently within the C-Corp structure—taxed initially at 21%, rather than 40.8% in a pass-through environment.

Importantly, the DCP structure allows earnings to be distributed as compensation—not dividends—so funds can be extracted from the C-Corp without triggering dividend taxation. Over time, these distributions reduce the accumulated profits (AP) inside the C-Corp to zero, preparing the MSO for clean conversion to an S-Corp or wind-down, without leaving tax exposure behind.

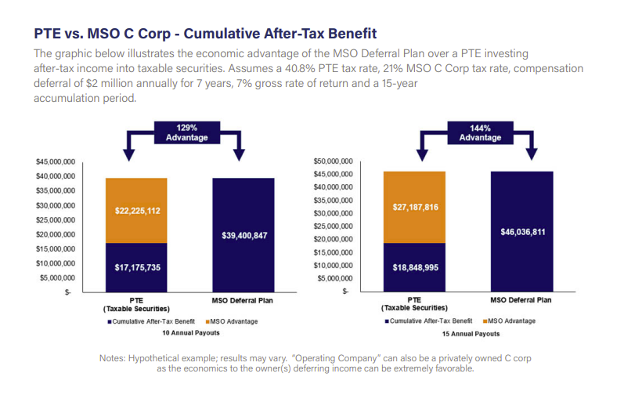

In a modeled example using $2 million of deferred income annually for 7 years, the total after-tax value after 15 years using the MSO+DCP strategy was $46,036,811 compared to just $18,848,995 in a standard pass-through structure.

That’s a 144% increase in total wealth using the MSO-based deferred comp approach.

This strategy allows the owner to fund retirement, supplement an earn-out, or build generational capital—all while controlling the timing and tax character of income.

➤ C-to-S Conversion

Before beginning payouts, the MSO can be converted to an S-Corp. This allows all DCP benefits to be deducted at the entity level while flowing through as ordinary income to the owner—creating one last round of tax leverage before the business winds down.

Illustration: $2M Deferred Annually Using MSO Strategy Before Exit

Let’s walk through a modeled example:

- Business value: $35M

- MSO defers $2M annually for 7 years into COLI-backed DCP

- Funds grow at 7% annual return for 15 years

- Post-sale, MSO is converted to S-Corp and begins distributions

Results:

Strategy | 15-Year Net Value |

PTE Structure | $18,848,995 |

MSO Strategy | $46,036,811 |

Advantage | +$27,187,816 |

This single structure can deliver more wealth post-sale than the value of the business itself.