Maximize Tax Savings and Retain Key Talent: The MSO Deferred Compensation Plan™ Every Business Owner Should Know About

Introduction

As a business owner, one of the biggest challenges you face is balancing tax efficiency with retaining key executives. Traditional nonqualified deferred compensation plans, while effective for C corporations, have been out of reach for pass-through entities (PTEs) like S Corporations due to immediate taxation issues. However, the Management Services Organization (MSO) Deferred Compensation Plan™ offers a transformative solution that bridges this gap and creates substantial benefits for privately held businesses.

The Problem: Tax Roadblocks for PTE Owners

Pass-through entity owners, such as S Corporations, often hit a wall when trying to defer income. Unlike C Corporations, any deferred income is immediately taxed, which strips away the advantages of long-term tax deferral. Consequently, PTE owners face a major hurdle when trying to build wealth while keeping more of what they earn. Without a viable alternative, privately held businesses remain at a disadvantage when designing retention strategies for owners and executives.

The Solution: MSO Deferred Compensation Plan™

The MSO Deferred Compensation Plan™ provides a practical and tax-efficient solution. By establishing an MSO as a C Corporation, businesses can defer income and unlock significant tax savings while incentivizing key executives. Nevertheless, this plan is suitable only for privately held businesses with legitimate business purposes, such as employee retention, nonqualified plans, succession planning, and business continuity strategies. Proper documentation and compliance with governing laws are critical for its success.

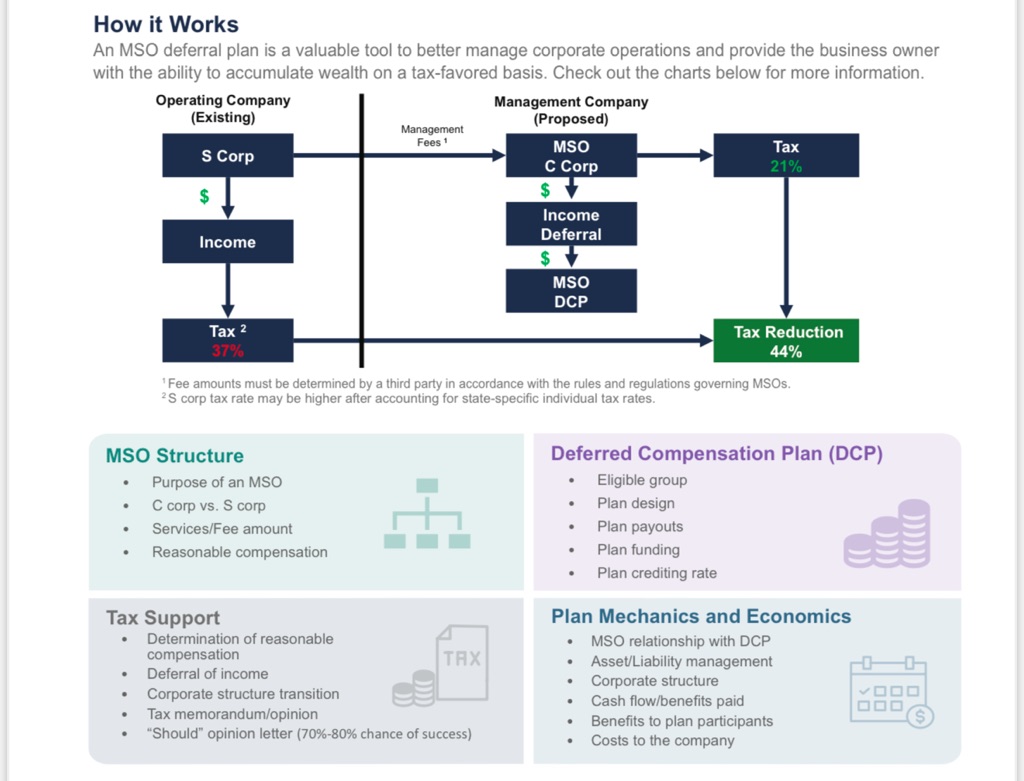

How It Works

MSO Creation: The business establishes an MSO as a separate C Corporation.

Management Agreement: The operating company pays a deductible management fee to the MSO for services rendered.

Reasonable Compensation: A portion of the fee is allocated as compensation for executives, which can then be deferred.

Deferred Compensation: Executives defer income pre-tax into a plan, where it grows tax-deferred over time.

Tax Arbitrage: The MSO income is taxed at a lower corporate rate of 21%, yielding substantial savings compared to individual tax rates of up to 37% (or higher with state taxes).

Why MSO Deferred Compensation Plan™ Makes Sense

Substantial Tax Savings: Leveraging the lower 21% corporate tax rate reduces the tax burden and creates more cash flow for investments.

Wealth Accumulation: Owners and executives can grow wealth faster through tax-deferred compounding.

Enhanced Business Continuity: Funds in the MSO can be used for buy-sell agreements, retention, or business growth.

Retention Power: A deferred compensation plan is a strong tool for attracting and keeping top executives.

Flexible Plan Design: The MSO allows tailored plans to meet business and employee needs.

A Hypothetical Example: Big Savings in Action

Imagine deferring $2 million annually into an MSO Deferred Compensation Plan™ for seven years with a 7% annual return over 15 years. By leveraging the MSO’s 21% tax rate instead of the 40.8% PTE rate, the cumulative after-tax benefit could be 30-100% higher than traditional taxable investments. As a result, this allows for significant long-term savings and improved cash flow.

Implementation Steps

Discovery Meeting: Assess feasibility for your business.

Compensation Analysis: Engage third-party experts for reasonable compensation evaluation.

Legal and Tax Setup: Establish the MSO and deferred plan with legal guidance.

Funding and Administration: Enroll executives and manage the plan using secure, cloud-based platforms.

Ongoing Support: Monitor compliance and refine the strategy based on business and tax needs.

Why Act Now?

The MSO Deferred Compensation Plan™ isn’t just a tax strategy—it’s a comprehensive tool for improving cash flow, securing top talent, and creating sustainable wealth. However, it’s only effective for privately held businesses with legitimate purposes like employee retention, nonqualified plans, or succession strategies. Additionally, proper documentation and compliance are key to avoiding IRS scrutiny.

Learn More and Get Started

Discover how the MSO Deferred Compensation Plan™ can transform your business:

Mezrah Consulting: MSO Overview

Mezrah Consulting: Tax-Advantaged Strategies

Mezrah Consulting: Contact Us

Guardian Tax Consultants: MSO Deferred Compensation™

Guardian Tax Consultants: Employee Retention Strategies

Guardian Tax Consultants: Wealth Accumulation Tools

Guardian Tax Consultants: Business Tax Planning

Guardian Tax Consultants: Contact Us

5690 West Cypress Street, Suite A

Tampa, Florida 33607

Phone: 813.367.1111

connect@mezrahconsulting.com

https://mezrahconsulting.com/about-us